Key Role of SWIFTBIC Codes in Global Money Transfers

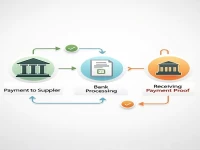

This article discusses the SWIFT/BIC code MTBLBDDHGUL of MUTUAL TRUST BANK PLC. and its significance in international remittances. It emphasizes the importance of accurately providing this code to ensure secure and efficient fund transfers. The article also suggests verifying relevant information before sending remittances to avoid potential payment errors.